does nh tax food

A 9 tax is also assessed on motor. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Delaware Montana Alaska Oregon and New Hampshire do not have state sales tax.

. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Alongside the State of Alaska New Hampshire is one of two states that have neither a state income tax nor a sales tax. Is food tax exempt in all states.

New Hampshire has no. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. However each of these states regulates its own excise taxes income taxes and taxes on.

Please note that effective october. Since the state controls all. New Hampshire Consumer Taxes at a Glance New Hampshire does not have a sales tax and has some of the lowest gasoline taxes in the country.

Income Tax Range. The Tobacco Tax and the Communications Services Tax exemplify some of the risks of relying on relatively small revenue sources dependent on certain types of economic activity. This means that New Hampshire has amongst the.

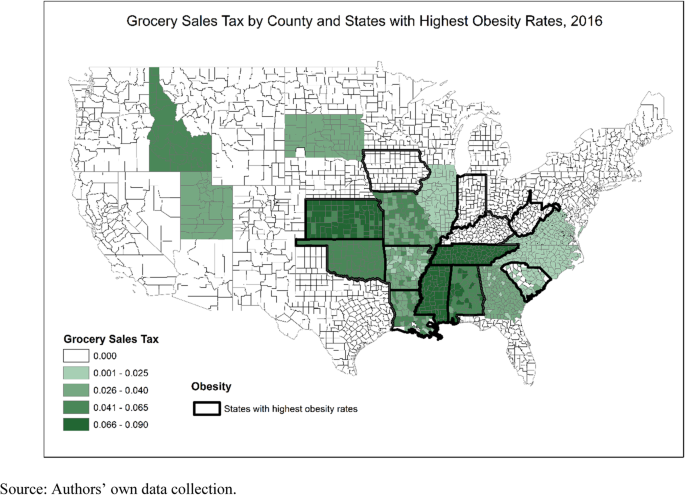

A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. If calling to inquire. What is not taxed in New Hampshire.

Call the Departments Tobacco Tax Group at 603 230-4359 or write to the NH DRA Tobacco Tax Group PO Box 1388 Concord NH 03302-1388. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. New Hampshire doesnt have an income tax.

A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency. Depending on the type of business where youre doing business and other specific. However currently theres a 5 tax on dividends and interest in excess of 2400 for individuals 4800.

The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room. New hampshire rules vary greatly from federal laws and include the business profits tax business enterprise tax and rooms and meals tax.

Depending on the type of business where youre doing business and. Tax policy in New. Does nh tax food.

There are however several specific taxes levied on particular services or products.

Food Service Industry Department Of Taxation

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Filing Taxes For On Demand Food Delivery Drivers Turbotax Tax Tips Videos

States Cut Taxes For Income Gas Property And Groceries Money

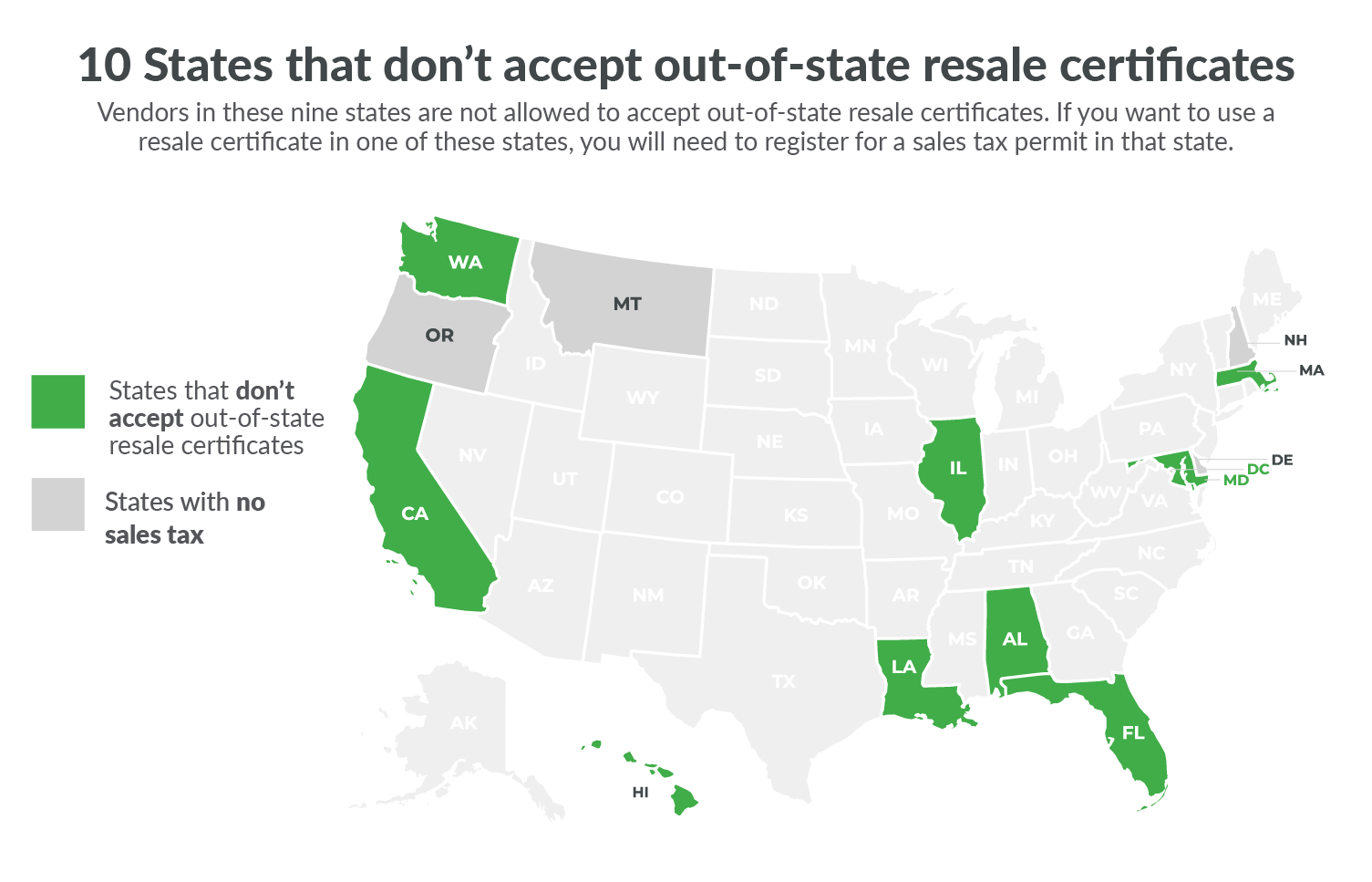

10 States That Won T Accept Your Out Of State Resale Certificate Taxjar

Kelly Goes Shopping For Sweet Food Sales Tax Repeal Settles For Gradual Reduction Kansas Reflector

Ohio Sales Tax Small Business Guide Truic

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Food Tax Repeal Think New Mexico

New Hampshire Meals And Rooms Tax Rate Cut Begins

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States With Minimal Or No Sales Taxes

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

9 States With No Income Tax Kiplinger

The Most And Least Tax Friendly Us States

States With The Highest And Lowest Sales Taxes

Do Safety Net Programs Impact Food Security In The United States Econofact